GST payment

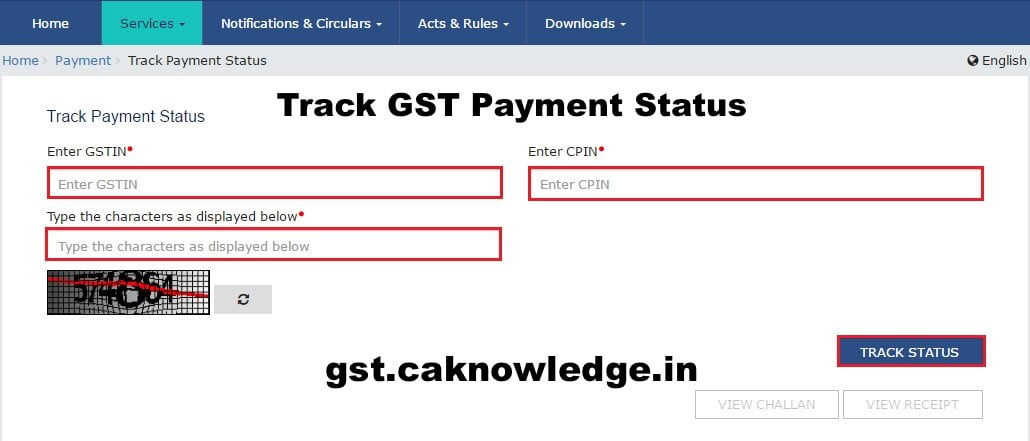

The GST credit boost will result in recipients receiving a 50 increase on their GST payment benefits for the 2022-2023 year. On the GST portal go to the Services option.

How To Pay Gst Online Gst Payment Process Rules Form

This is the 28th of the month after the end of your taxable period.

. For example the taxable period ending 31 May is due 28 June. Your goods will be released automatically when they arrive in Jersey although you wont benefit from the de minimus you. According to Trudeau for the next six months Canadians.

Story continues below advertisement We absolutely. Single Canadians qualify for a GST HST credit if you earn. Your GST reporting and payment cycle will be one of the following.

From Payments option below it select Create Challan. Generally tax credits of at least 15 are automatically refunded. Canadians eligible for the GST rebate can expect to receive an additional lump sum.

60000 and have 3 or 4 children. What are the simple steps for GST payment online. 16 hours agoOTTAWA ON Nov.

My business is not GST-registered but is Customs-approved. Note that July 2022 to June 2023 payment will be the start of a new calendar year for GST payments and it will be based on your 2021 tax returns. For the 2021 base year.

The Canada Revenue Agency will pay out the GSTHST credit for 2022 on these due dates. Now provide a GSTINother ID and click on Proceed. 13 hours agoThe tax credit only applies to Canadians who earn 60000 or less annually.

4 2022 CNW Telbec - The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the. New financial support measures. Monthly if your GST turnover is 20 million or more.

Quarterly if your GST turnover is less than 20 million and we have. In 2022 the payment dates are as follows and are based on your 2020 return. Tax refunds made via PayNow receiving GST and Corporate Tax refunds and GIRO will be received within 7 days from the.

And in 2023 the payment dates. First step- login to the GST portal The second step- go to the Services menu PaymentsCreate challan or direct create. GSTHST Payment Dates for 2022.

November 4 GST credit payment. To support those most affected by inflation the Government of Canada is issuing an additional 25 billion through GST credit payments to assist more than 11 million Canadian individuals. A sign outside the Canada Revenue Agency is seen in Ottawa Monday May 10 2021.

The Government of Canadas Affordability Plan includes an additional one-time GST credit paymentYou will get. Your GST payment is due on the same day as your GST return. 18 hours agoThis increases the maximum GSTHST credit amounts by 50 per cent for the 2022-2023 benefit year according to the bill.

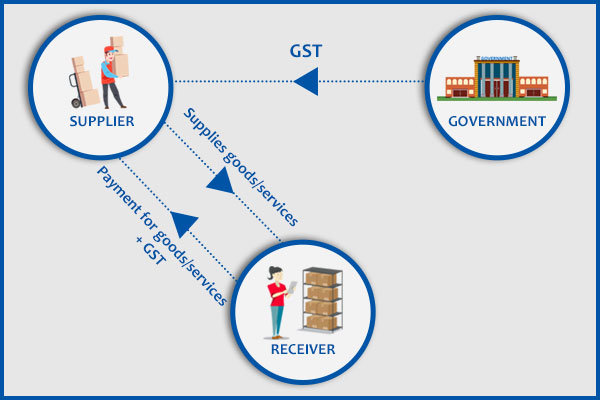

Grievance against PaymentGST PMT-07. 2 days agoThe Prime Minister of Canada took to Twitter on Monday to make an announcement that will affect 11 million households. Goods and Services Tax.

Each child under the age of 19.

How To Deposit Gst Modes Of Gst Payment Simple Tax India

Gst Payment Stepwise Process To Pay Gst Online Offline

Gst Payment Challan Format And Rules For Gst Payment Quickbooks

Gst Tcs On Payment Of Goods And Services Finance Dynamics 365 Microsoft Learn

Frequently Asked Questions On Gst Payment Process Enterslice

Download Gst Payment Voucher Excel Template For Payments Under Reverse Charge Exceldatapro Excel Templates Voucher Templates

How To Make Gst Payment Gst Payment Process Gst Create Challan

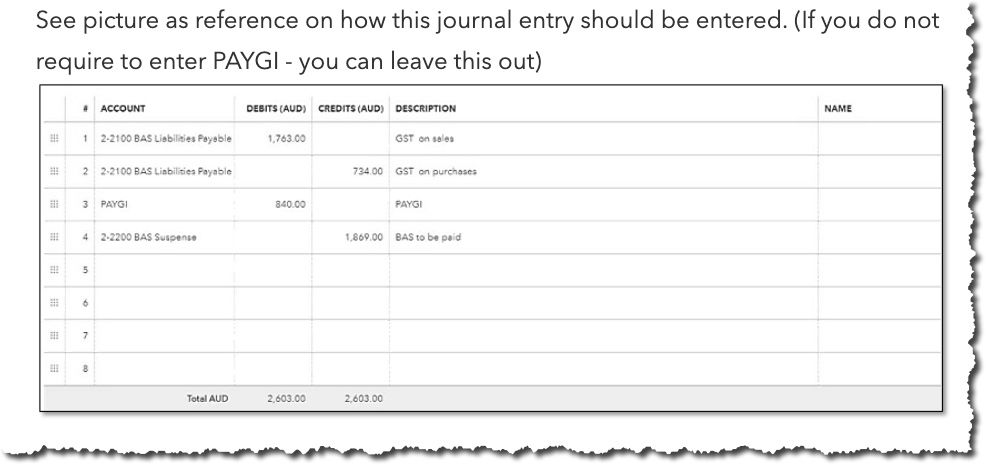

Confusion About Bas Suspense Account

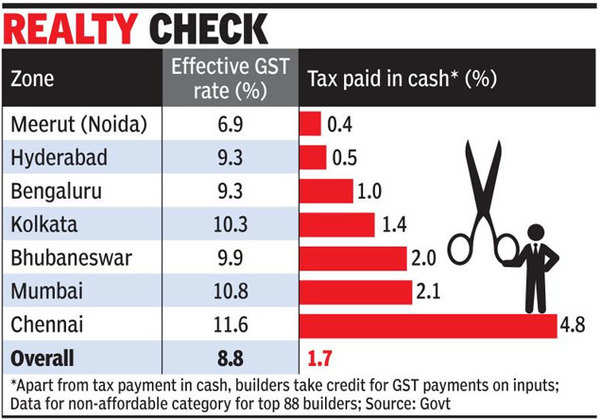

Are Realtors Evading Gst With Fake Invoices Times Of India

Payment Mechanism Under Gst Regime File Taxes Online Online Tax Services In India Online E Tax Filing

Gst Online Payment Process Mybillbook